Commercial and Business Insurance

Business insurance protects businesses from the financial losses associated with unexpected events, including property damage, lawsuits, loss of income, theft, employee injuries and illnesses, and workers’ compensation. Put simply, in cases of injury or damage, your business insurance reimburses your company, either fully or partially, for the costs. Think of business insurance as a layer of protection.

“Business insurance”—sometimes called commercial insurance—is an umbrella term, not the name of a business insurance policy you can buy. In fact, when you start researching business insurance, you might notice there are nearly as many types of policies as there are businesses. Depending on the type of insurance you need and the policies you choose, business insurance can cover:

Theft

Property damage

Liability protection

Lawsuits

Vehicle insurance

Loss of income

Employee injuries/illnesses

Workers’ comp

Customer injury

You can also get a business owner’s policy (BOP), which is an insurance package that combines general liability insurance, commercial property insurance, and business income insurance into a single policy.Business Insurance description.

Term Life Insurance

Term life insurance can be a great way to help protect a family's financial future. Individuals can get coverage when they need it most, and pay less on premiums.

Whether you're searching for Life Insurance, Annuities, IRA's and other retirement strategies, you must be well-informed and well-advised to get the most out of your premium dollars. An experienced and independent agent who represents multiple insurance carriers can make a huge difference in what you pay for coverage.

Index Universal Life Insurance

Index Universal Life insurance can help protect a family's standard of living or help fund children's education in the event of the death of the insured. The policy also offers options to change death benefit amounts or adjust premium payments within certain limitations.

Customers should cover all their bases when preparing for the future. Should they pass away unexpectedly, they want their loved ones to receive death benefit to help replace lost income, pay off debt, or cover living expenses, additionally their policies could accumulate cash value that may be accessed in retirement to help meet their needs.

Whole Life Insurance

Whole Life insurance, also known as traditional life insurance, provides permanent death benefit coverage for the life of the insured. In addition to paying a death benefit, whole life insurance also contains a saving component in which cash value may accumulate. Interest accrues at a fixed rate and on a tax-deferred basis.

The two primary types of life insurance are whole life and universal life insurance combines a death benefit with savings portion. Whole life insurance offers coverage for the full lifetime of the insured and its savings can grow at a guaranteed rate.

![piggy bank - image of a pig bank]()

What is an Annuity?

The term "annuity" refers to an insurance contract issued and distributed by financial institutions with the intention of paying out invested funds in a fixed income stream in the future. Investors invest in or purchase annuities with the monthly premium or lump-sum payments. The holding institution issues a stream of payments in the future for a specified period of time or for the remainder of the annuitant's life. Annuities are mainly used for retirement purposes and help individuals address the risk of outliving their savings.

Foreign Nationals Insurance

Foreign nationals who regularly visit, do business, or own property in the United States may be unaware of the potential estate tax exposure they may face. Our life insurance solutions can help address this very issue.

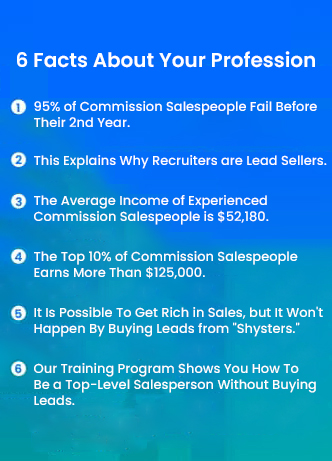

Why Should I Call This Agency for Insurance?

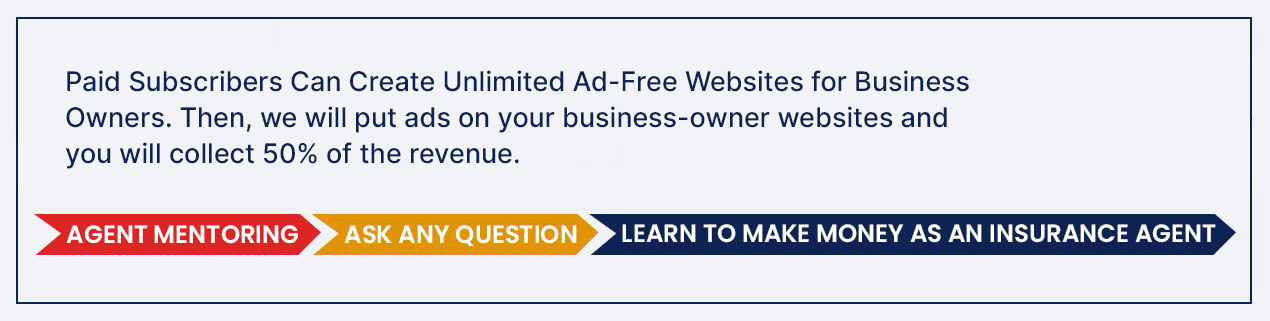

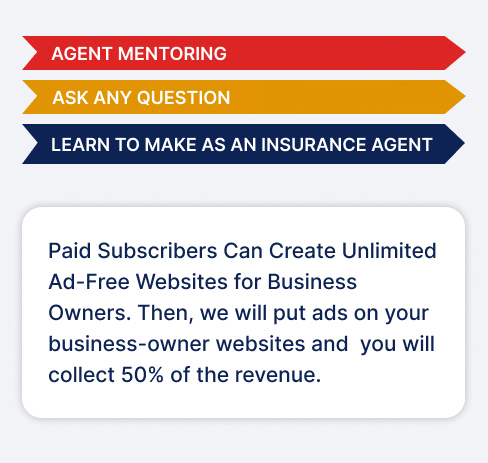

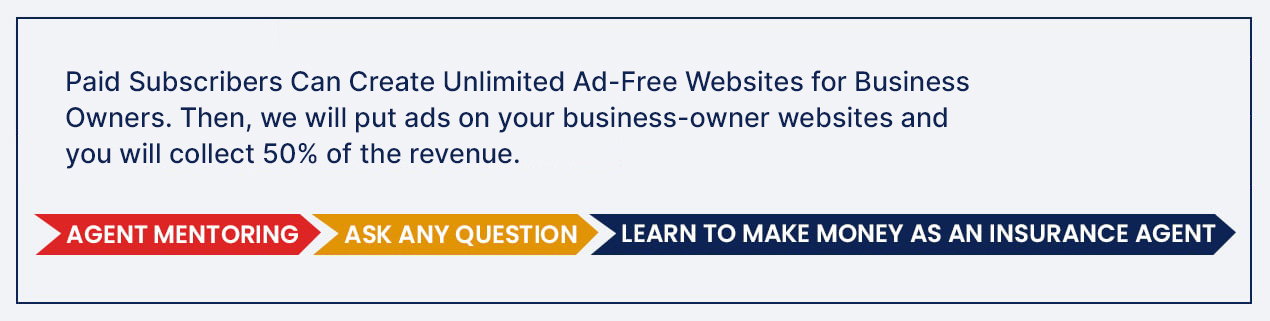

Good question. There are a lot of insurance agents out there and it may seem like any agent or broker is as good as another. But we are decidedly different.

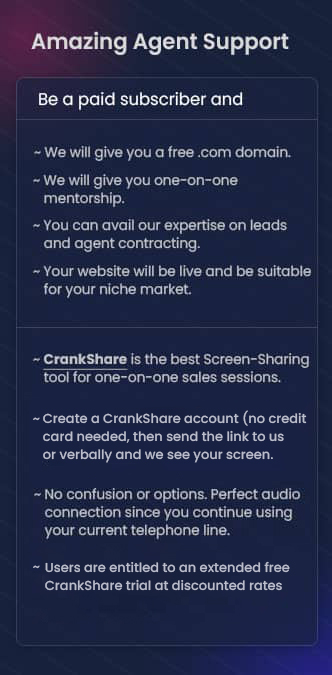

Let's face it, insurance jargon can be very confusing. We know the ins and outs of the insurance business, and our inside knowledge of many companies and many products will work to your advantage. In fact, different insurance companies often charge vastly different premiums for the exact same coverage. As independent agents we are not employed by one particular company. Instead, we can select insurance products from among those companies that best address your unique concerns.

We promise to focus our attention on your benefit exclusively.

![]()

Please don't hesitate to call us with your questions no matter whether you are already a valued customer, a potential client or if you simply need expert advice. There will never be a charge for our assistance or for a friendly, no-obligation chat.

Whole Life insurance, also known as traditional life insurance, provides permanent death benefit coverage for the life of the insured. In addition to paying a death benefit, whole life insurance also contains a saving component in which cash value may accumulate. Interest accrues at a fixed rate and on a tax-deferred basis.

The two primary types of life insurance are whole life and universal life insurance combines a death benefit with savings portion. Whole life insurance offers coverage for the full lifetime of the insured and its savings can grow at a guaranteed rate.